The Complete Guide To Gold IRA Accounts

페이지 정보

작성자 Pearline 작성일 25-08-22 02:33 조회 6 댓글 0본문

On the planet of investment, diversification is key to managing risk and maximizing returns. One in all the preferred options to traditional retirement accounts is the Gold Particular person Retirement Account (IRA). This text will explore what a Gold IRA is, how it works, its benefits, potential drawbacks, and find out how to set one up.

What's a Gold IRA?

A Gold IRA is a type of self-directed IRA that enables traders to hold bodily gold and other precious metals as a part of their retirement portfolio. Unlike conventional IRAs, which sometimes hold stocks, bonds, and mutual funds, a Gold IRA provides investors the opportunity to invest in tangible property. This can be particularly appealing in occasions of financial uncertainty, as gold has historically been considered as a safe haven.

How Does a Gold IRA Work?

Setting up a Gold IRA entails several steps:

- Choose a Custodian: The IRS requires that every one IRAs be held by a professional custodian. This custodian must be accredited to handle valuable metals. Buyers ought to research and select a custodian with a stable reputation and expertise in managing Gold IRAs.

- Open an Account: After choosing a custodian, best companies for retirement ira rollover you will need to open a Gold IRA account. This course of is just like opening a standard IRA and typically involves filling out paperwork and providing identification.

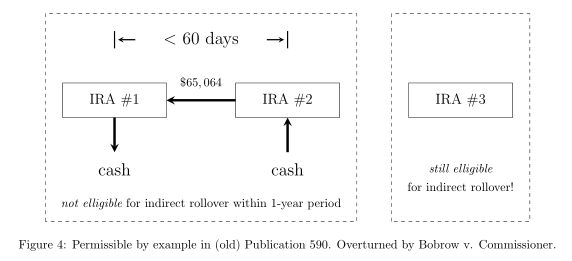

- Fund the Account: You'll be able to fund your Gold IRA by numerous strategies, including rolling over funds from an present retirement account, making a money contribution, or transferring belongings from another IRA. Remember of contribution limits set by the IRS.

- Buy Gold: As soon as your account is funded, you can buy gold and other accepted treasured metals. The IRS has specific tips concerning the types of metals that may be included in a Gold IRA, including gold, silver, platinum, and palladium. The metals should meet certain purity standards and be saved in an authorized depository.

- Storage: Bodily gold should be saved in an IRS-accepted depository. This ensures that the metals are safe and meet IRS regulations. Traders can't keep the gold at home, as this is able to violate IRS rules.

- Withdrawals: Similar to conventional IRAs, withdrawals from a Gold IRA are subject to tax and best companies for retirement ira rollover penalties if taken before the age of 59½. Once you reach retirement age, you may start taking distributions, which will be in the form of cash or bodily gold.

Benefits of a Gold IRA

Investing in a Gold IRA comes with a number of benefits:

- Hedge In opposition to Inflation: Gold has historically maintained its worth over time, making it a reliable hedge towards inflation. When the value of paper foreign money declines, gold often rises in value, preserving purchasing power.

- Diversification: Together with gold in your retirement portfolio can provide diversification. This can help mitigate dangers related to inventory market volatility and financial downturns.

- Tangible Asset: Not like stocks and bonds, gold is a bodily asset you can hold. This tangibility can provide peace of mind for best companies for retirement ira rollover investors who're involved about the stability of monetary markets.

- Tax Advantages: Like conventional IRAs, Gold IRAs offer tax-deferred development. This implies you won’t pay taxes on the gains out of your investments till you withdraw funds from the account.

- Protection Against Geopolitical Dangers: Gold is a worldwide asset that's not tied to any specific nation. This makes it a protected haven throughout geopolitical instability or financial crises.

Potential Drawbacks of a Gold IRA

Whereas there are various advantages to a Gold IRA, there are also some drawbacks to think about:

- Higher Fees: Gold IRAs often include increased fees in comparison with traditional IRAs. These can embrace custodian fees, storage charges, and transaction fees for getting and promoting gold. It’s necessary to understand all costs related to a Gold IRA before investing.

- Restricted Investment Options: A Gold IRA restricts your investment options to precious metals. This may restrict your skill to diversify inside your retirement account, as you won’t have access to stocks, bonds, or mutual funds.

- Market Fluctuations: Whereas gold is usually viewed as a secure investment, its value can still be volatile. If you have any sort of inquiries relating to where and the best ways to make use of best companies for retirement ira rollover, you can call us at the page. Buyers ought to be prepared for fluctuations out there and understand that gold costs will be affected by varied elements, including economic circumstances and modifications in supply and demand.

- Regulatory Compliance: Gold IRAs must comply with IRS laws, which might be advanced. Buyers need to stay informed about these rules to keep away from penalties.

Find out how to Set up a Gold IRA

Setting up a Gold IRA entails several easy steps:

- Analysis Custodians: Look for reputable custodians who focus on Gold IRAs. Test their fees, companies, and buyer opinions.

- Open an Account: Full the necessary paperwork to open your Gold IRA account with your chosen custodian.

- Fund Your Account: Determine how you want to fund your Gold IRA, whether or not by a rollover, switch, or direct contribution.

- Choose Precious Metals: Work with your custodian to choose which gold and other precious metals you need to include in your portfolio.

- Storage Arrangements: Be sure that your chosen custodian has safe storage choices in an IRS-permitted depository.

- Monitor Your Funding: Commonly overview your Gold IRA’s efficiency and keep informed about market conditions that will affect the worth of your investments.

Conclusion

A Gold IRA could be a worthwhile addition to your retirement portfolio, offering diversification, a hedge towards inflation, and the safety of tangible assets. Nevertheless, it’s essential to grasp the associated prices, regulatory requirements, and best companies for retirement ira rollover market dangers. By fastidiously considering your funding targets and conducting thorough research, you can decide if a Gold IRA is the fitting alternative to your retirement technique. As all the time, consulting with a financial advisor can provide personalized steerage tailor-made to your distinctive financial situation.

- 이전글 PokerTube And Love - How They're The same

- 다음글 The Most Common Order Counterfeit Money Debate Actually Isn't As Black And White As You May Think

댓글목록 0

등록된 댓글이 없습니다.